- SG Thoughts

- Posts

- Is Ethereum Dead?

Is Ethereum Dead?

Did the switch to PoS put the nail in the coffin?

Did Ethereum’s switch to PoS Kill Ethereum?

Launched in 2015, Ethereum revolutionized the crypto landscape with its smart contract functionality that allowed the development of a wide array of dApps. As the second-largest cryptocurrency by market capitalization, Ethereum is recognized for its thriving application ecosystem.

However, the platform currently faces a dual challenge: scaling to support an increasing user base and transaction volume while maintaining its foundational principle of decentralization. Recent developments, including the transition to Ethereum 2.0 with a proof-of-stake (PoS) consensus mechanism and new solutions like liquid staking and MEV (Maximal Extractable Value) strategies, aim to address these issues.

Yet, these advancements also bring potential risks. This article will delve into some of the controversial aspects of Ethereum’s development, focusing on the threats of centralization posed by liquid staking and MEV, and their implications for the future of the network.

Ethereum’s Transition to PoS: Where Centralization Issues Emerge?

Without a doubt, the network’s change from proof-of-work (PoW) to proof-of-stake (PoS) with the Ethereum 2.0 upgrade marked a significant milestone. This transition not only improved Ethereum’s security and energy efficiency, but it also opened the door for users to participate in securing the network through staking.

While the change from a PoW consensus model to a PoS opened the door to let users stake ETH to secure the network, a new constraint was uncovered: staking was somewhat limiting for users as it restricted their assets to earn solely through staking, limiting any other potential utility. The staked assets became illiquid, generating income only from a single source.

Adding up to the limitations of staking, solo staking has a minimum requirement of 32 ETH which makes interested stakers to steer away. In fact, solo staking is at an all time low, it makes a small percentage of all staking on Ethereum.

A new workaround came out to solve this problem.

Liquid staking enhanced users to stake their ETH in the network and earn rewards while maintaining the flexibility to use their assets in other DeFi activities. This solved the problem of limited liquidity that stemmed from “traditional” staking.

Liquid Staking: A Double-Edged Sword

However, like many solutions in this world, they come at a cost.

Liquid staking was a solution to make staking on PoS more flexible. In general terms, it works by giving users tokenized versions of their staked ETH. These tokens can then be used in DeFi protocols, allowing users to earn from the combination of staking rewards and having accessible, liquid assets that users are free to invest in the protocol of their liking.

As mentioned above, solo staking is at an all-time-low. Since the entry barrier is high, users have steered into other staking options and currently, most of Ethereum’s staking is done via Lido and other projects that allow liquid staking.

Source: 21co. Ethereum Staking & Withdrawals. Dune

This is where problems begin to emerge.

The concentration of staking power on a central provider like Lido poses a serious threat to Ethereum’s security and decentralization. This goes against Ethereum’s core principles, whereby staking power is supposed to be distributed across a wide base of network participants.

MEV and the Centralization Dilemma

Maximal Extractable Value (MEV), previously known as Miner Extractable Value, refers to the additional revenue that miners or validators can capture by strategically including, excluding, or reordering transactions within a block.

In PoW blockchains, MEV worked by allowing miners to generate revenue outside of block rewards and fees through their influence on the network. This included reordering transactions to prioritize them and by processing complex transactions that create opportunities for miners to extract more value by exploiting inefficiencies caused by added complexity.

Vitalik’s Perspective

Buterin’s opinion on liquid staking is very clear: while liquid staking has democratized access to staking, the associated centralization risks must be addressed to preserve Ethereum’s decentralization and security above all.

He shares the concerns mentioned above and has proposed solutions. Vitalik recognized that while innovations in the network provide significant benefits, many times they can also pose risks that need to be mitigated. He proposes a balanced approach. For example, he supports enhancing the governance rights of smaller stakers and exploring protocol changes that distribute power more evenly across the network.

Progress is being made: Rainbow Staking, Verkle trees, and EIP-4444

Vitalik showed support for Rainbow Staking. It is a conceptual framework to improve the staking situation on Ethereum by enabling participants to contribute to the network’s security and functionality.

“Rainbow” represents the broad spectrum of participants and services in the network. The framework aims to integrate various classes of service providers like professional operators, solo stakers, and capital providers in the ecosystem. The network then offers tailored protocol services that adapt well to each participant’s unique strengths and value proposition.

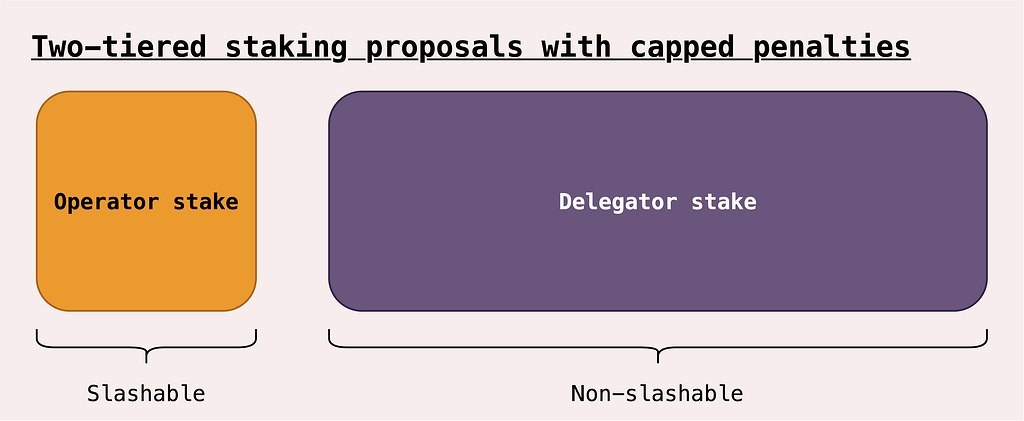

Rainbow will differentiate between two main service categories:

Light Services: these are services that require lower hardware requirements And economic incentives, making them accessible to a larger base of participants that includes solo stakers. Light services have limited slashing risks but they are still essential to maintain the network's health and decentralization, they just don't carry as many risks as heavy services.

Heavy Services: these services are critical for the network and respectively, carry more responsibilities and risks. These services are slashable in case they perform incorrectly and they include operators who handle the high stakes and complex requirements.

Rainbow also proposes operator–delegator separation to help clarify the relationships within all services and address conflicting incentives. The whole purpose behind Rainbow is to maintain Ethereum’s core principles of decentralization and security while adapting to the growing needs of the network. By creating a balanced, inclusive framework for all types of stakers, they hope to counteract the dominance of a single liquid staking token.

Verkle Trees and the EIP-4444 are other two innovations being introduced into Ethereum to further improve efficiency and decentralization. Verkle Trees are a new cryptographic data structure that features much smaller and efficient proofs compared to Merkle Trees. This improvement would have a direct impact on cost associated with running a node, as the amount of data that nodes need to store and process is reduced. More participants would be able to be solo stakers, thus promoting decentralization.

On the other hand, the EIP-4444 proposes pruning old state data from Ethereum nodes, which would also significantly lower storage requirements. Nodes would only need to keep recent state data, while older data could be offloaded to specialized history nodes or accessed on demand from other nodes. If both Verkle Trees and EIP-4444 are implemented, hardware requirements of an Ethereum node could plausibly eventually decrease to less than a hundred gigabytes.

Then, Is Ethereum Dead?

Despite concerns raised by liquid staking and its impact on decentralization, Ethereum is far from gone. Ignited by the transition to PoS, challenges have definitely arised, especially regarding centralization risks posed by major staking providers like Lido. Nevertheless, these concerns sparked innovation that will not only address them, but leave a more robust Ethereum.

Innovations such as Verkle trees and EIP-4444 showcase Ethereum’s resilience and commitment to decentralization. Additionally, concepts like Rainbow Staking offer a structured framework to balance the roles of solo stakers and professional operators, enhancing both decentralization and network security.

These solutions show that while the switch to PoS significantly made Ethereum steer from its initial vision momentarily, Ethereum remains robust, decentralized, and capable of evolving thanks to constant innovations.

Sources

🔸Restaking and LRTs Interview🔸

What is restaking?

What problem does it solve?

Is it the next big narrative?

What about risk concerns?I asked all these questions and more to @KelpDAO cofounder @GAmitej in a long interview.

Here is everything you need to know 🧵👇🏻 x.com/i/web/status/1…

— Crypto Koryo (@CryptoKoryo)

6:09 PM • Jan 23, 2024